Common stock dividend calculator

As for the dividend per share DPS the. Similar to common stock preferred stock is typically assumed to last into perpetuity ie.

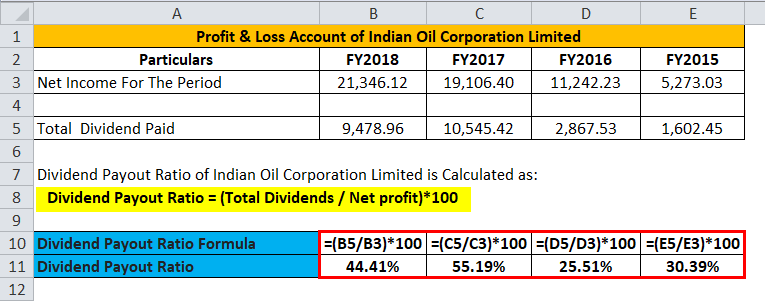

Dividend Payout Ratio Formula Calculator Excel Template

An example is a 2-for-1 split.

. MO Common Stock Dates Activity Cumulative Stock. Preferred stock differs from common stock in that it typically does not carry voting rights but is legally entitled to receive a certain level of dividend payments before any dividends. As a unit of ownership common stock typically carries voting rights that can be exercised in corporate decisions.

With an unlimited useful life and a forever-ongoing fixed dividend payment. Rates are much higher than the rates of equity or common stock. The procedures for stock dividends may.

Nasdaq stocks that have raised dividends for more than 10 years in a row and have a minimum three-month average daily trading volume of at least US 1 million. Shares of common stock also represent an ownership stake in the underlying company. These shares can also pay out a dividend though payment amounts and the timing for when they arrive is not fixed the way it is with preferred shares.

Stock profit calculator to calculate the total profit or loss on any stock that you buy and sell. Just 199 for a limited time normally 399. Is Antero Midstream NYSEAM a good stock for dividend investors.

This is when a company increase the number of shares it has outstanding. A common one is stock splits. In the above example the ex-dividend date for a stock thats paying a dividend equal to 25 or more of its value is October 4 2017.

Step 2 Find the conversion ratio also called a gearing ratio in the. Calculate the value of dividend returns based on the last dividend declaration date. This includes yield.

Skip to main content. The stock split ratio - The most common ratios are 21 or 31. Best Dividend Stock Screener in 2022 As of 09152022.

The stock dividend may be additional shares in the company or in a subsidiary being spun off. Warren Buffett Dividend Stock 3. 4-for-1 Stock Split.

So if you had 50 shares after the split you would have 100. A stock split is an event similar to when a company issues a dividend. Common Stock Definition.

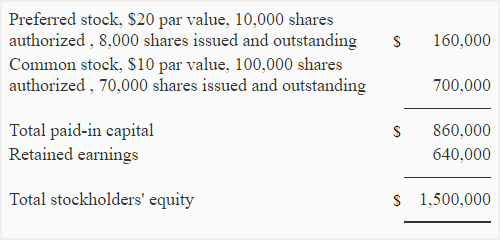

Stock typically takes the form of shares of either common stock or preferred stock. Preferred Dividend formula Par value Rate of Dividend Number of Preferred Stocks 100 008 1000 8000. Dividend Aristocrats As of 09142022.

Honing in on just the right stock ETF or. Online Calculators Financial Calculators Stock Profit Calculator Stock Profit Calculator. Hence the cost of preferred stock is analogous to the perpetuity formula as used in the valuation of bonds and debt-like instruments.

While shares of common stock always have voting rights if they offer a dividend it isnt guaranteed. American Express Company AXP American Express Company is offering a quarterly dividend yield of 132 or 208 per share annually which is not as common as it. The present annualized dividend rate is 376 per common share.

Many online stock brokers now offer commission free trades the stock calculator. Honing in on just the right stock ETF or mutual fund for your goals is paramount. The simple stock calculator has options for buying price and selling price as well as trading commissions for each trade.

By this we mean the companys board of directors first announces its intention to split the companys stock. Its Time To Embrace Another 25 Decline In The SP 500. 50 OFF MarketBeat All Access.

It means that every year Urusula will get 8000 as dividends. For example if the stock is selling for 25 per share when the warrants are issued the exercise price might be 40 or more. Instead common stock dividend payouts are set by the board of directors.

At this time the board makes four announcements. 3-for-1 Stock Split. View the latest AM dividend yield history and payment date at MarketBeat.

While not guaranteed their dividend payments are prioritized over common stock dividends and may even be back paid if a company cant afford them at any point in time. Sometimes a company pays a dividend in the form of stock rather than cash. Common features of preferred dividend 1 Higher dividend rates.

To illustrate how to calculate stock value using the dividend growth model formula if a stock had a current dividend price of 056 and a growth rate of 1300 and your required rate of return was 7200 the following calculation indicates the most you would want to pay for this stock would be 961 per share. However as shown in our prior example companies. Even if a company has been paying common stock dividends regularly for years the board of.

Nasdaq stocks that have raised dividends for more than. This means that for every share you held before the split you would now have two shares.

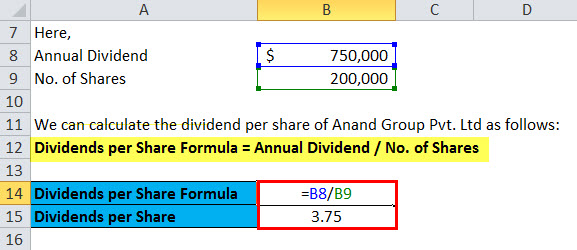

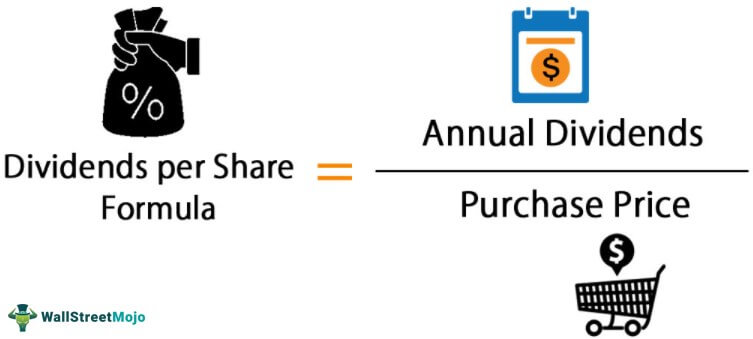

Dividends Per Share Formula Calculator Excel Template

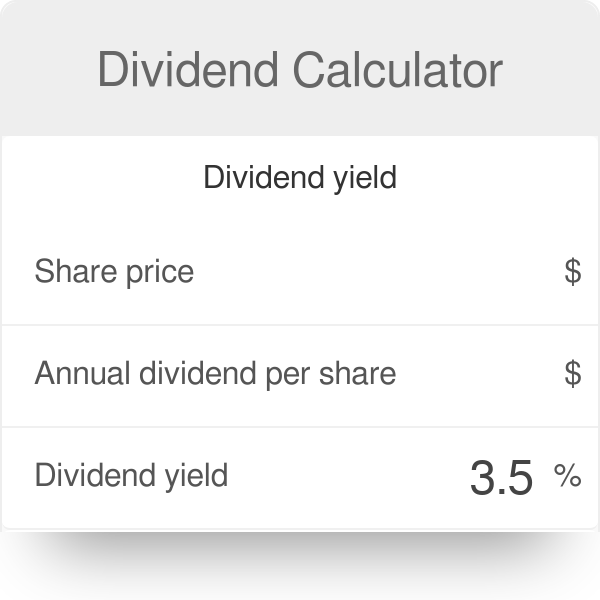

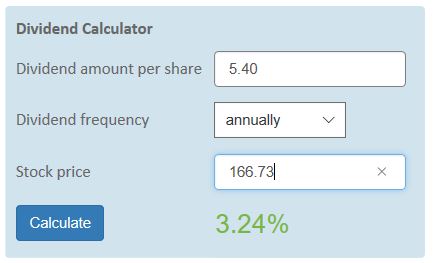

Dividend Calculator Definition Example

/dotdash_INV_final_Are_Marginal_Costs_Fixed_or_Variable_Costs_Jan_2021-012-68155744a01745e5be2659d6efee6ef9.jpg)

Do I Receive The Posted Dividend Yield Every Quarter

Dividend Payout Ratio Formula Calculator Excel Template

Common Stock Formula Calculator Examples With Excel Template

Dividend Yield Formula And Calculator Excel Template

Present Value Of Stock With Constant Growth Formula With Calculator

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Dividend Yield Formula And Calculator Excel Template

What Are Dividends Definition Types Simply Explained Finbold

Common Stock Formula Calculator Examples With Excel Template

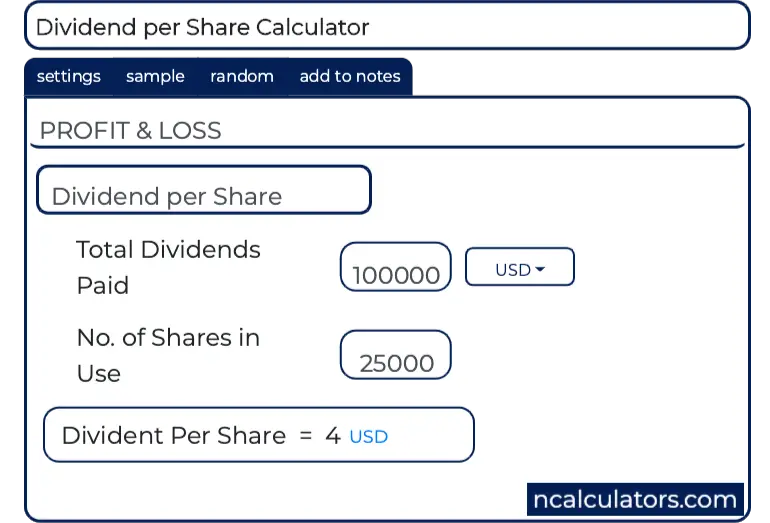

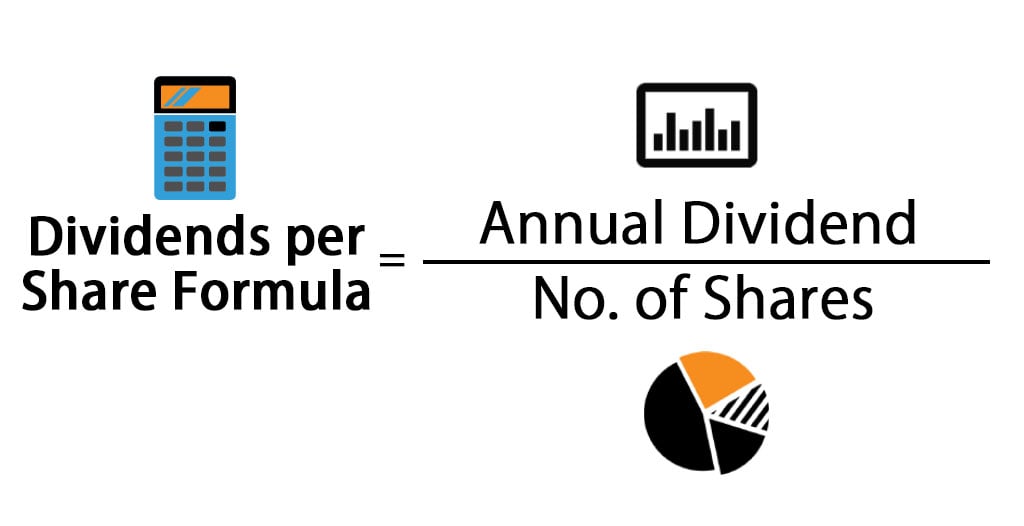

Dividend Per Share Dps Calculator

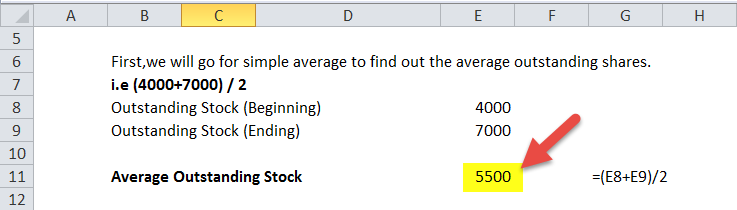

Dividends Per Share Formula Calculator Excel Template

Dividends Per Share Meaning Formula Calculate Dps

Dividend Yield Calculator

Dividends Per Share Meaning Formula Calculate Dps

Dividends Per Share Dps Formula And Excel Calculator