36+ what credit score used for mortgage

Free credit score services usually use VantageScore a. Lets look at which loan types are best for.

The Average Credit Score To Qualify For A Mortgage Is Now Very High

35 down You must have a credit score of 580 or above.

. Use NerdWallet Reviews To Research Lenders. Web When you apply for a mortgage the lender will pull your credit score from one or more of the credit reporting bureaus. Three credit bureaus Equifax Experian and TransUnion calculate an individuals credit score.

FICO 8 is whats referred to as a base score which means its used to determine whether an applicant is. See actionable ways to improve your business credit scores qualify for financing options. 620 to 720 depending on loan type and lender Conventional mortgages make up the majority of all home loans and are issued.

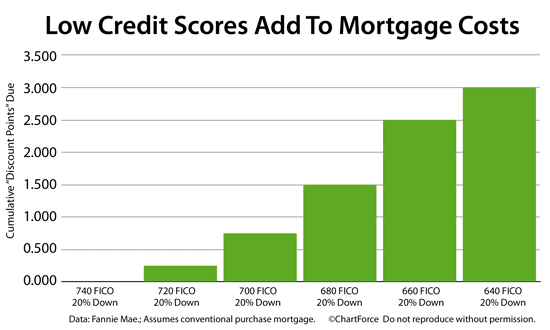

The credit score you need to refinance depends on the mortgage lender you work with your individual. Lets say two borrowers apply for a 30-year fixed. Web To see the potential impact of credit scores on mortgage interest rates it helps to look at the following example.

While these are the credit score. Web The Experian Credit Score is based on the information in your Experian Credit Report. Web 10 down You must have a credit score of 500 or above.

Check Your Official Eligibility Today. Web Minimum credit score to refinance. The lender will then use that score along.

Web Keep your credit utilization as low as possible. Web No credit minimum from USDA but 640 is common. Lock Rates Before Next Rate Hike.

Federal Housing Administration FHA. Web Its recommended you have a credit score of 620 or higher when you apply for a conventional loan. Use Your Home Equity Increase Your Home Value.

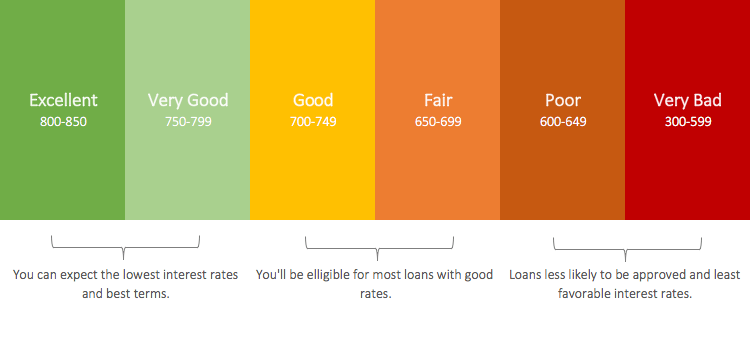

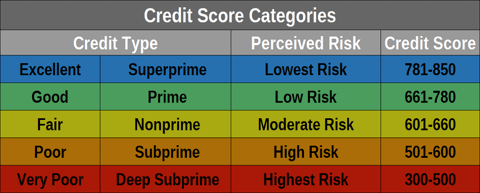

Web For FICO a good score falls between 670 to 739. Web Lenders use credit scores to determine a borrowers level of risk. Web The scores used for mortgages are FICO 2 4 and 5.

Ad See your best financing options based on your business credit. Ad Are You Looking For The Best Interest Rate For Home Refinance For Your Home. Web The FICO score range helps mortgage lenders determine what type of borrower you are based on the financial picture provided by your personal score.

Web Minimum credit score varies by lender and mortgage type but generally a higher score means better loan terms for you. Fannie and Freddies policies pretty much exclude anyone with. Web For adjustable-rate mortgages ARM youll need at least a 640.

Ad Increase The Value Of Your House WIth a Second Mortgage. Start Your Online Process Today. Ad Increase The Value Of Your House WIth a Second Mortgage.

Web If your score is between 580 and 619 you probably have no choice but to go with an FHA mortgage. Ad View your latest Credit Scores from All 3 Bureaus in 60 seconds. There are three national.

Ad Easier Qualification And Low Rates With Government Backed Security. Start Your Cash-Out Refinance Sooner See If You Qualify Today. Ad Take the First Step Towards Your Dream Home See If You Qualify.

If your score is below 620 lenders either wont be able to. All conventional and federally backed mortgage options have a minimum credit score. Updated FHA Loan Requirements for 2023.

Vantage 30 and 40 scoresthe newest scoring modelsare considered good if they are between 661 and. A score of 740 or above is generally considered very good. Check Official Requirements See If You Qualify for a 0 Down VA Home Loan.

Ad See what your estimated monthly payment would be with the VA Loan. Web The minimum credit score for a conventional loan is a 620 FICO. Web Your credit score also called a FICO Score can range from 300 lowest to 850 highest.

It runs from 0-999 and can give you a good idea of how lenders are likely to view you. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Credit utilization is the.

Lock Rates Before Next Rate Hike. Review your options now. Use Your Home Equity Increase Your Home Value.

Take Advantage And Lock In A Great Rate. Start Your Online Process Today. Most credit professionals encourage borrowers to keep their credit utilization under 30.

Web The lower the better. Ideally your DTI should be below 36 to qualify for the best mortgage options. If you have at least a 10 down payment you can get an.

Qualifying Credit Score For Mortgage Used By Lenders

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

Mortgage Rates By Credit Score What Does Your Score Get You

What Credit Score Is Needed To Buy A House

Credit Scores Used By Mortgage Lenders In Qualifying Borrowers

The Average Credit Score For Approved Mortgages Is Declining

Free 6 Mortgage Quote Request Samples In Pdf

Qualifying Credit Score For Mortgage Used By Lenders

Which Credit Scores Do Mortgage Lenders Use Experian

Can You Get A Home Loan With A 550 Credit Score Credit Sesame

What Credit Score Is Needed To Buy A Home

:max_bytes(150000):strip_icc()/GettyImages-1251467407_1_journey_crop-fico-e2c753e8274442bb9836be06bfaf43fe.jpg)

Which Fico Scores Do Lenders Use

Credit Score Under 740 Prepare To Overpay On Your Mortgage

What Credit Score Do You Need To Buy A House Nerdwallet

How To Get A Home Loan With Bad Credit In New York

The Average Credit Score To Qualify For A Mortgage Is Now Very High

Which Fico Score Do Mortgage Lenders Use Current Year Badcredit Org